Fiscal Horizon 2030

The current tax ecosystem is at a turning point, nationally and internationally. Principles of the early 20th century - such as physical presence as a point of reference for taxability - are under pressure in an economic landscape where business models increasingly rely on digitisation and sustainability and where transparency determines the tax strategy.

These developments open up opportunities for the tax authorities to ease the administrative burden, facilitate cooperation between tax authorities and deal with tax evasion. At the same time, the transformation offers companies and organisations opportunities to use taxation as a lever for innovation and growth. And to avoid (unpleasant) tax surprises.

Digital, transparent and sustainable

‘What does this mean specifically for my business?’ we hear you ask. Thanks to the digital transformation, you can expect the tax authorities to gain direct access to the data in your IT/ERP systems. Or at least the sales invoices. Based on this big data, they can perform real-time tax audits and, through deep learning and artificial intelligence, expose underlying (global) connections and detect inconsistencies. It is therefore important to prepare your company for this digital transformation and to use digital technology to fine-tune and automate your own tax processes.

In turn, more transparency has a positive impact on your tax position. Tax errors or alleged unethical behaviour have a profound impact on the trust of your stakeholders, internally and externally. An effective tax policy and risk model creates clarity and at the same time optimises your cost efficiency.

It may sound strange, but this is how taxes are also an important ESG benchmark (Environment, Social and Governance): external stakeholders are interested in the tax behaviour of your company and how you take your tax responsibility and create economic value for society.

An added bonus are the tax incentives from the government that encourage sustainable entrepreneurship. Take, for example, the tax benefits for green investments and innovations (read the inset text on innovation subsidies). Or incentives that discourage environmentally harmful decisions.

Tax policy and risk model

Due to the increasingly complex tax systems, increased tax reporting obligations and closer national and international cooperation between tax authorities, many businesses are missing out on tax benefits or opportunities, more so than in the past. In other words, the need for a well-founded tax policy and risk model is growing.

Isn't that a complex and expensive proposition that requires a lot of effort? Only for the benefit of multinationals? Wrong! An effective tax policy and risk model need not be complex at all. It can be tailored to the needs of each company.

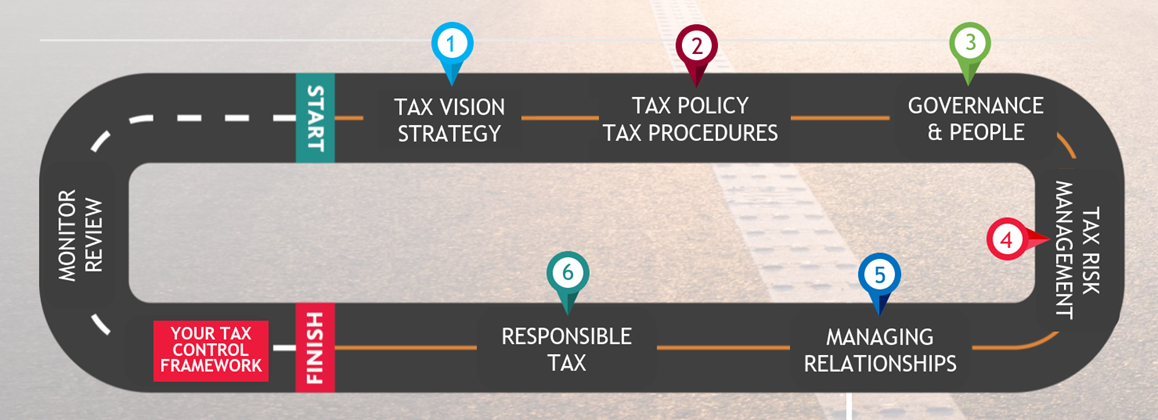

Where do you start? Our experts will help you find out. Starting from your current situation, your plans and your specific sector. The core of your tax policy and risk model is a robust Tax Control Framework (TCF). Such a framework helps you to accurately document your tax return and reporting. At the same time, you gain a better understanding of the vulnerabilities of your tax policy and are able to optimise procedures and processes. Moreover, a TCF helps you tackle problems resulting from an unexpected audit result, high staff turnover in the finance department, rapid growth, etc.

As a guideline, our tax experts have developed a ‘Tax Control and Operating Framework Roadmap’. This hands-on guide provides a framework and tools for effective tax management.

Innovation grants

.From project financing to investing in people and assets: to innovate you need capital – and not just a little. The federal and regional governments offer a range of incentives, but do you know for which support measures or innovation grants your company or organisation is eligible? We have listed all the possibilities in our report ‘Let’s talk about Innovation’. We brought together the most common subsidies per region in a separate fact sheet.