Sustainable business

The world, our society and therefore companies and organisations are in the middle of what the United Nations (UN) has proclaimed the “Decade of Action”. No more fine words to make our planet a better and liveable world for everyone. High time for action! The goals are on paper - the UN’s 17 Sustainable Development Goals (SDGs), for example, or the European ambition to be a climate-neutral economy by 2050. The question is, how can you as a company or organisation contribute to and participate in this sustainability transition?

That transition is not without good reason by the way. It is literally - vital to remain relevant as a company in the future. Sustainable business is not only the right way, but also the smartest way. There are risks and opportunities. After all, more and more factors have a major impact on your business. Consider the conditions in the context of capital provision, new regulations and legislation on waste processing or energy efficiency, changes in car taxation, pressure from customers who are required to report on ESG performance (Environment, Social and Governance) in their chain, (future) employees who consciously choose transparent employers, or pressure from other stakeholders. Today, waiting is no longer an option.

‘Sustainability is the new digital’. And you don't want to be left behind in that. In short, sustainable business is also a business case for your company, small or large, and not about sandals and nut cutlets.

Sustainable business = innovation

Short-term gains are no longer the sole motive for economic growth and prosperity. We are measuring the wrong things too much today. A forest fire may have a positive impact on GDP in the short term - reconstruction is economically viable - but in the long term it erodes the well-being of climate, the environment and people.

Freely translated: sustainable business means creating value, taking into account the impact of your company on your stakeholders, society and the planet. So well-being, job satisfaction, safety, health, work-life balance, CO2 footprint, efficient (re)use of raw materials, etc. are becoming and are indeed already extremely important indicators.

And if you say sustainable business, you say innovation. Innovating with and in new technologies, in circular economy, in behavioural change, in leadership that looks beyond the horizon. The ESG model makes the objectives concrete and tangible for yourself, and for everyone inside and outside your organisation.

Starting or boosting

Start with what is feasible. Start by designing your sustainability project or boost an existing programme. Decide the goals on which you can, want and sometimes have to focus. Be aware of the fact that ever more stakeholders (customers, suppliers, employees, etc.) consciously opt for sustainable entrepreneurs. As BDO, we want to set a good example and encourage our business partners.

This is how our sustainability consultants provide instruments and tools. Customised, taking into account the sector, scale, maturity and sustainability plans of your company or organisation. One of these tools is our ‘Sustainability Dashboard’, which allows you to define the indicators or parameters that are relevant for your business, within your sector.

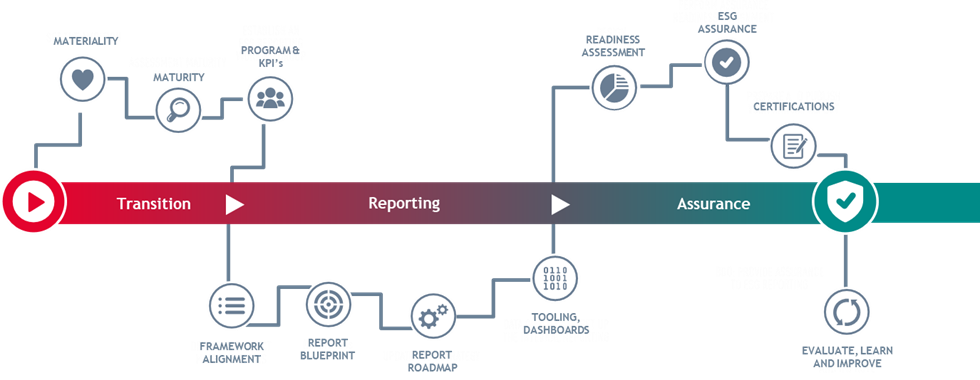

Our approach has three phases

- Phase 1: we initiate the sustainability transition through strategy and implementation in three phases: materiality, maturity and an ESG programme.

- Phase 2: we support internal and external reporting on ESG, taking into account current and future frameworks and standards.

- Phase 3: in the form of a ‘readiness assessment’, we give an assurance that the correct and consistent reporting is in line with current, future and increasingly complex regulations. And we integrate ESG in the risk and return analysis in the context of value creation through mergers & acquisitions (ESG due diligence).