Finance

The CFO of tomorrow is sure to be a “digital CFO”. Digitalisation is of course much more than just introducing a new IT tool here and there – the results of which are often frustrating later on. A recognisable situation? Then it is time to really push forward, even if technology is not part of your “natural” metier.

For instance, have you already fathomed out the power of artificial intelligence (AI) or machine learning? The forward-looking finance expert knows that there is AI that can be particularly useful in his field. He or she also understands what this technology can mean for his or her objectives. Without that insight, you can no longer dream. Believe us.

In fact, experience shows that many finance departments are still far from applying digitalisation in enough depth to have a significant impact on the effectiveness, efficiency and strategic value of what they do. And yet it is precisely the most efficient CFOs who control and proactively manage the flows and quality of their data. Who, based on a mix of reliable (!) data from different angles (financial, operational, marketing, etc.), can make meaningful analyses with which the company can really get to work in order to improve profitability and generate future cash flows.

Combine the right ins and outs

For the CFO, the power of technology lies in the well-oiled combination of operational and financial data. Know, for example, that thanks to technology today, you can also process less or unstructured data, such as text or visual data, into your analyses and reports. Does this mean that a CFO must become a programmer as well? No, but you have to be able to empathise with the world of technology in order to be able to roll out the right solution for the right finance application. And ultimately to achieve the intended cost reduction and value creation

In short, now is the time to give up old certainties and routines and switch over to integrate, advanced data and financial management. Management that meets the new digital challenges while also minimising workloads and the resources required.

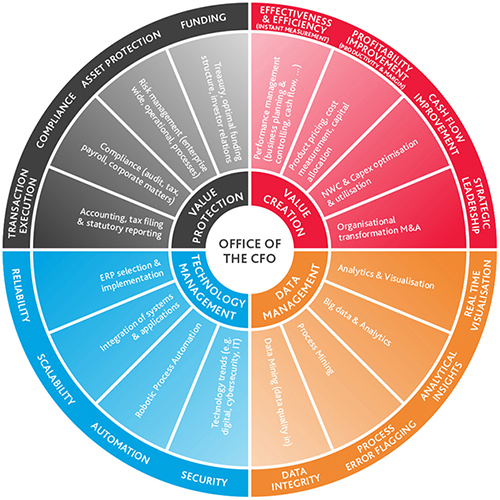

To test whether you can achieve these goals with existing resources and strategy, our experts have developed the “Office of the CFO”, a 360° performance scan tailored to the CFO.