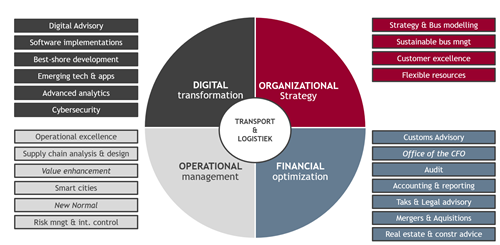

Financial optimisation

In one way or another, all links in the business chain have a financial/fiscal component. For example, the post-calculation of the vehicle return, the salary processing, the financing of investments, the cost price calculation, the impact calculation of reorganisations or acquisitions, the preparation of subsidy files, the external and domestic VAT and excise duty settlement, and so on.

Our multidisciplinary team thinks along with you and helps you to make the right choices for your organisation. And in doing so, it calls on colleagues who are experts in very specific fields or niches. Or on those who themselves have customers in the banking or insurance sector and who thus know the ins and outs of that world.

With our advice, we help to guide you through the complex world of customs and excise. Is your company compliant with the constantly changing national and international rules? Does it apply processes and procedures optimally and efficiently? Where can things be done even better? Perhaps a specific training course via our BDO Academy will bring more clarity or perhaps a hands-on training course will sharpen the knowledge and skills of your employees? About AEO certification, for example, or IRF, the new ‘Brexit trade agreement’, customs regulations, excise duties, VAT, etc.

All CFOs ask themselves whether their finance department is performing as well as it should and whether it will be able to handle future challenges. What’s the degree of performance (including digital), relevance and accuracy of the available data, analyses and reports? Our finance experts have gathered together the challenges that CFOs face and created an ‘Office of the CFO’ concept - a 360° policy that focuses on four domains: technology, data management, value creation and value protection.

You rely on specific advice and guidance in every phase of your company’s life cycle. We provide you with a single point of contact for the coordination and management of all your financial obligations and objectives. Your ‘personal’ adviser is not alone, by the way. He or she is surrounded by a team of financial analysts, accountants, auditors, tax specialists and consultants. And he or she makes sure that the right specialists get to work for you. Both in Belgium and abroad. Count on our financial advice and our training.

Our experienced tax consultants and tax experts form a team of generalists and specialists who work seamlessly together. While the generalists focus on all-round solutions, from the broader perspective of business-economical or private equity legal needs, the specialists concentrate on complex subdomains, such as VAT, international tax law, and transfer pricing (‘BEPS’) regulations.

We assist you in clarifying objectives and analysing risks and pitfalls. And help you in conducting negotiations and due diligence investigations, drafting or reviewing a letter of intent, drafting a purchase or sales agreement or handling the post-acquisition or merger formalities.

Our legal team has built up years of concrete experience and know-how. Additionally, they continuously consult with their colleagues specialising in other disciplines such as taxation, finance, labour law, etc. The bottom line: as a multidisciplinary team, they make a thorough assessment of all the risks and pitfalls associated with your transaction and put each party’s agreements on paper in clear and understandable language, no matter how complex or how technical the subject matter.

Our Real estate sector group forms a multidisciplinary and complementary team of specialists in audit and financial advice, supported by tax and legal advisers. It has to be so. After all, a logistics construction or infrastructure project has so many facets - from idea, through development, realisation and maintenance to the finding (on time) of the investments - and parties. Each with their own specific requirements, tools and knowledge.